Use the FREE mortgage payoff calculator app and calculate your early payoff and savings!

Your new payment is: $ ${000}

You save a total interest of: $ {000}

Payoff your loan {000} months faster

Mortgage Payoff Calculator

How much can Refinance save you?

Do Extra Payments make a difference?

How Early can you pay it all off?

See for Yourself

- Mortgage Payoff Calculator

- Mortgage Payoff Calculator: How to use? (with screenshots)

- Step 1

- Step 2

- Step 3: Impact of refinance on mortgage payoff

- Step 4: Impact of extra payment on mortgage payoff

- Step 5: Impact of both – refinance and extra payments on mortgage payoff

- Conclusion: For early payoff of mortgage, there are two very effective levers you can pull: make extra payments and refinance to a lower rate

- Mortgage Payoff Calculator: How to use? (with screenshots)

Mortgage Payoff Calculator: How to use? (with screenshots)

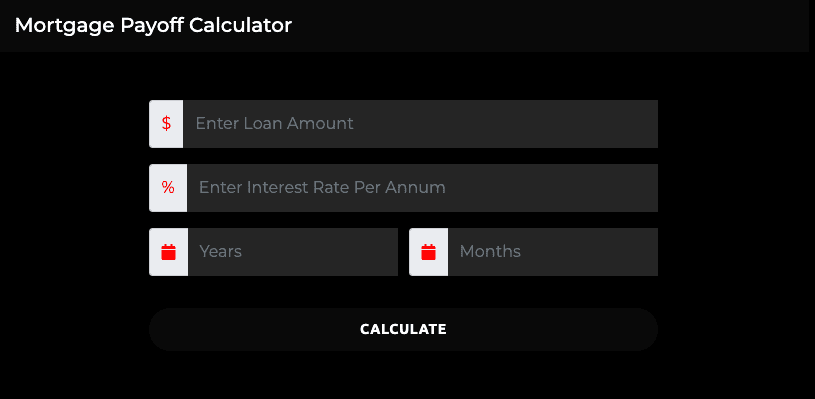

Step 1

Fill in all the relevant values such as the loan amount for example $400,000, interest rate (yearly) for example 4.00%, loan tenure in years and months, for example, 30 years and 0 months.

After filling in the details, hit the calculate button at the bottom.

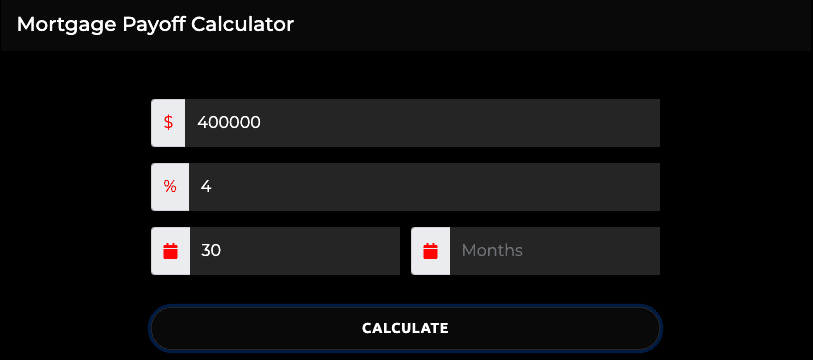

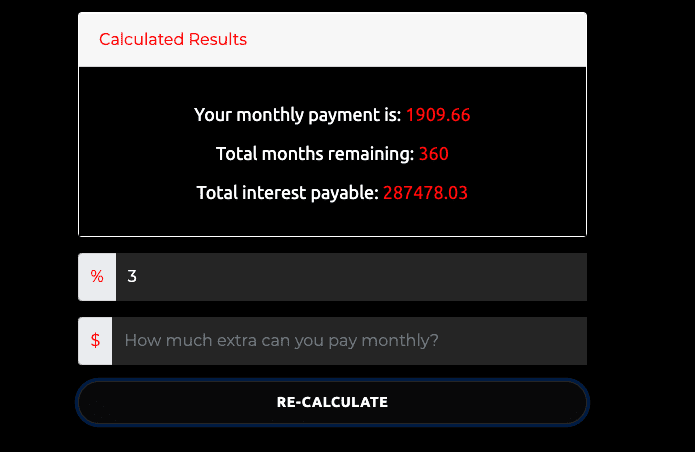

Step 2

Using the information provided in the form, the app calculates the following:

Monthly payment – how much you’re supposed to pay every month: $1909.56

Total months remaining – how many months you’d have to make the payment to pay off the mortgage: 360 (i.e. 30 years you had input)

Total interest payable – this is the sum of all interest payments (on top of your principal amount or the borrowed amount of $400,000) you would pay to pay off the loan: $287,478.03

So effectively, you’d pay $287,478 (interest) + $400,000 (principal) = $687,478 in total.

Till here, it’s the basic mortgage repayment math. Next, we will explore the impact of two things –

- refinancing mortgage to a lower rate

- making extra payments on top of calculated ‘monthly payment’

There are two new fields for that.

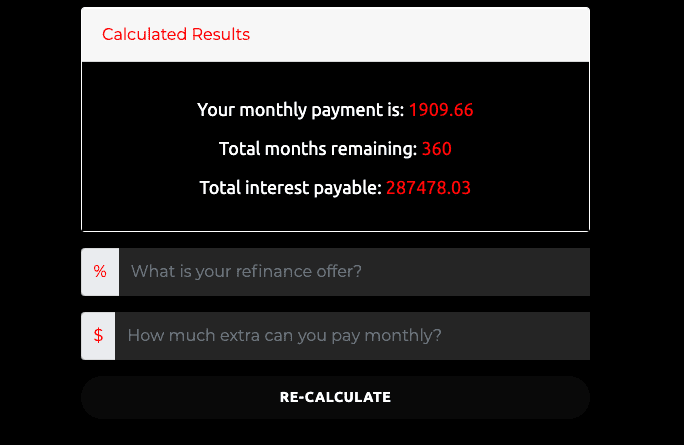

Step 3: Impact of refinance on the mortgage payoff

You should always check for refinancing offers on all your loans.

Suppose you find a lender that is willing to refinance your mortgage at a lower rate, for example, 3.00%. Enter 3.00 in the ‘what’s your refinance offer’ field.

Hit the RE-CALCULATE button to see the impact of refinancing at 3%

We observe that based on the lower interest rate of 3%, the new monthly payment is $1686.42, down from $1909.66.

A 1% lower interest rate on a mortgage enables you to save $80,368 in total interest!!!

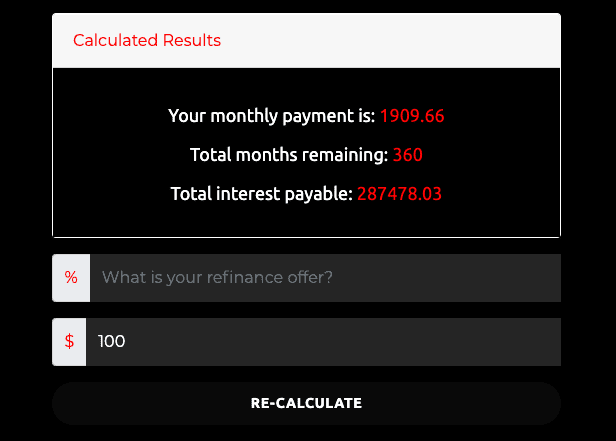

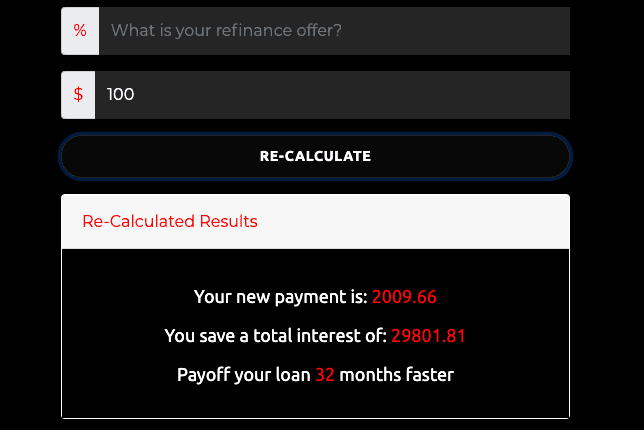

Step 4: Impact of extra payment on the mortgage payoff

If you are not able to find a lower interest rate currently, you can still accelerate your mortgage payoff by making small extra contributions every month.

Let’s say you can pay $100 extra every month, input 100 in the appropriate field and hit RE-CALCULATE.

The app recalculates your scenario taking the extra payment into account.

Based on the updated information, the new payment becomes $2,009.66 ($1909.66 suggested monthly payment + $100 extra payment).

$100 extra monthly payment enables you to pay off your mortgage 32 months faster and saves you $29,802 in total interest.

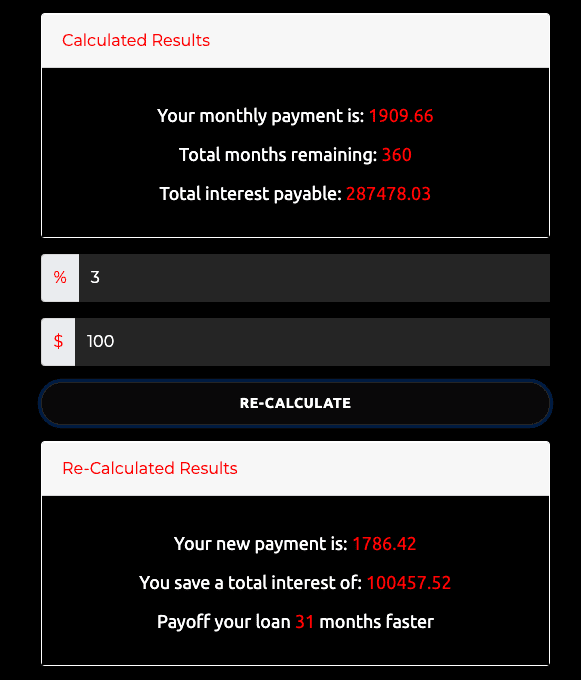

Step 5: Impact of both – refinance and extra payments on the mortgage payoff

Now this is the star scenario- you are able to refinance mortgage to a lower interest rate (3%) AND you commit to making extra payment ($100 per month) on the recommended monthly mortgage payments.

Based on the refinance rate of 3% and extra payment of $100 every month, your new monthly payment becomes $1,786.42 ($1,686.42 due to lower interest rate, as in step 3 + $100 extra monthly payment).

$100 extra every month and refinancing to a 1% lower interest rate enables you to pay off the mortgage 31 months faster and save $100,458 in total interest.

Conclusion: For early payoff of mortgage, there are two very effective levers you can pull: make extra payments and refinance to a lower rate

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Page Contents